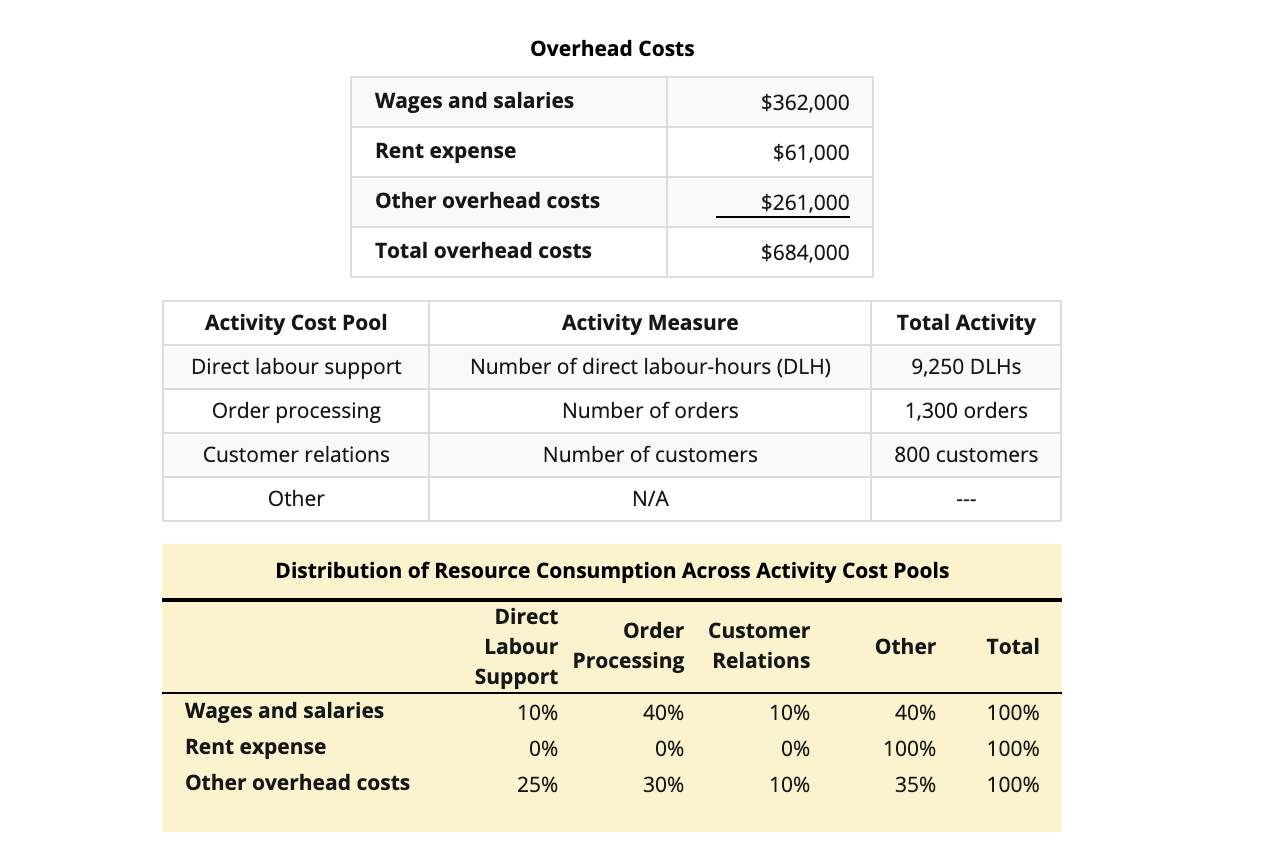

Employee salaries according to their respective cost centers.In the following example, overheads such as salary, rent, and insurance were broken down in the following manner: This practice also requires a highly cost-reflective breakdown of overhead types.

/GettyImages-172897808-7fcfaaf5f97d432eb22844d9d9d5353f.jpg)

HR and accounting department salaries, office supplies)īy means of the cost allocation method in table form – one of many cost accounting instruments – it is possible to spread overhead costs across all cost centers. factory rental, natural wear and tear of machinery) warehouse rental, salaries of workers from the purchase department, from the incoming goods warehouse, as well as those inspecting the goods) Overhead costs can be generally split into four separate categories: On the other hand, cost center overheads relate to branches, business departments, and product groups. Examples of the latter type include costs for rental, depreciation, as well as training- vehicle-, building-, energy-, advertising-, or telephone and internet-related costs. In general, there are two types of overheads – either cost center or those related to cost drivers. However, to cover overhead costs, it is advised to include them in the cost of individual products or services and to take them into account when determining their final value.

#Overhead expenses drivers#

Since direct costs can be assigned to individual cost drivers (which stands in stark contrast to overhead costs), they are easily determinable. The cost of a product or service is made up of direct and overhead costs, with both having a direct effect on the resulting price.

0 kommentar(er)

0 kommentar(er)